sales tax rate in tulsa ok

A county-wide sales tax rate of 0367 is applicable. The Oklahoma sales tax rate is currently.

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

The Tulsa County Sales Tax is collected by the.

. While sales tax revenues reflect retail sales in Oklahoma City use tax revenues reflect online sales. Select the Oklahoma city from the list of popular cities below to see its current sales tax rate. Average Sales Tax With Local.

Integrate Vertex seamlessly to the systems you already use. State of Oklahoma. The Tulsa County Sales Tax is 0367.

Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. This is the total of state county and city sales tax rates. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Has impacted many state nexus laws and sales tax collection requirements. 4 rows The current total local sales tax rate in Tulsa OK is 8517. Tulsa OK currently has 830 tax liens available as of July 22.

1063 maryport drive westfield. State of Oklahoma. The Tulsa County sales tax rate is 037.

The average cumulative sales tax rate between all of them is 828. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367. Combined with the state sales tax the highest sales tax rate in Oklahoma is 115 in.

Oklahoma has recent rate changes Thu Jul 01 2021. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. State of Oklahoma.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. As far as all cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Sales Tax in Tulsa Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The December 2020 total local. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax.

To review the rules in Oklahoma visit our state-by-state guide. 6 rows The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax. The County sales tax rate is.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. With local taxes the total sales tax rate is between 4500 and 11500. Fast Easy Tax Solutions.

Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 51. State of Oklahoma - 45. Oklahoma State Sales Tax.

The most populous location in Tulsa County Oklahoma is Tulsa. The Tulsa sales tax rate is. Ad Find Out Sales Tax Rates For Free.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The 2018 United States Supreme Court decision in South Dakota v. There are a total of 470 local tax jurisdictions across the state collecting an average local tax of 4264.

Tulsa County Sales Tax. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. The December 2020 total local sales tax rate was also 4867.

The current total local sales tax rate in Tulsa County OK is 4867. 892 Is this data incorrect. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

The state sales tax rate in Oklahoma is 4500. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables.

Tulsa revised ordinances to increase the monthly service charge. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables.

Sales And Use Tax Rate Locator

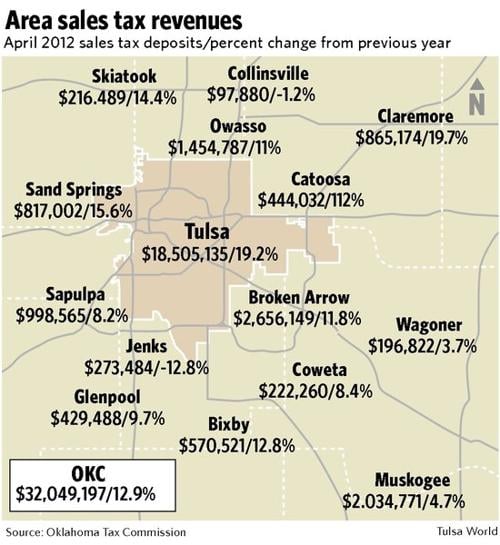

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

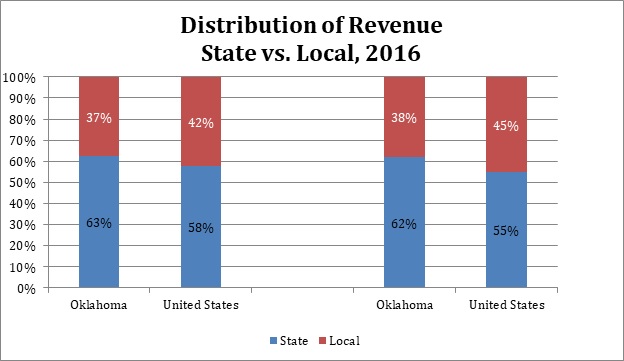

State And Local Tax Distribution Oklahoma Policy Institute

Oklahoma Sales Tax Small Business Guide Truic

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

File Sales Tax By County Webp Wikimedia Commons

Oklahoma Lawmakers On Both Sides Of The Aisle Push For Removal Of Sales Tax On Groceries Kosu

How To Calculate Cannabis Taxes At Your Dispensary

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Oklahoma State Tax Ok Income Tax Calculator Community Tax

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How Oklahoma Taxes Compare Oklahoma Policy Institute

Total Sales Tax Per Dollar By City Oklahoma Watch

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Harper County Voters Face Permanent 1 Sales Tax Hike

Property Taxes How Much Are They In Different States Across The Us

How To Charge Sales Tax On Avon Orders Youtube

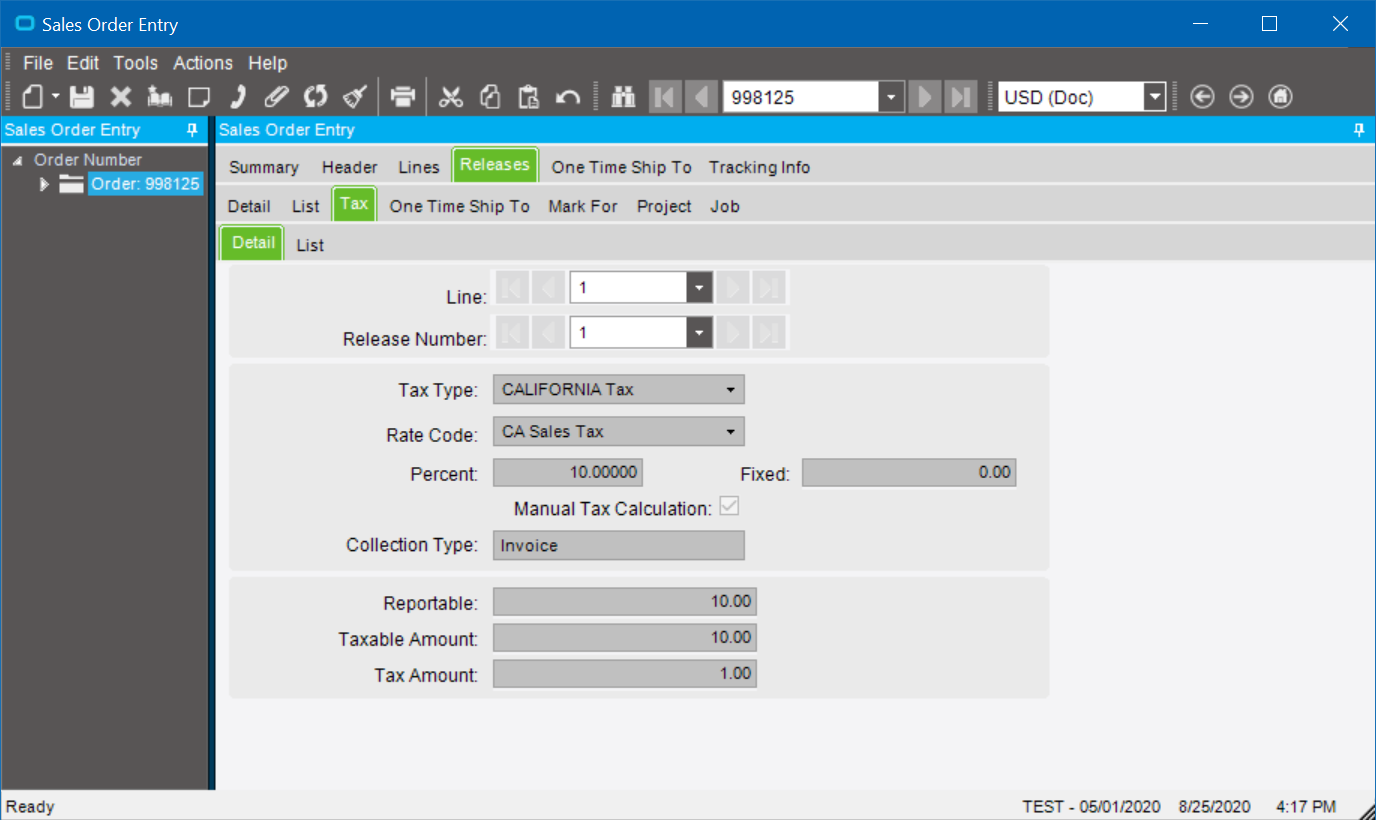

How To Get Invoices To Recognize Overridden Tax Rates Erp 10 Epicor User Help Forum